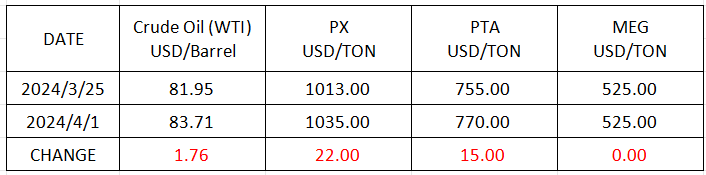

Market Trend (Mar. 18th -Apr. 1st,2024)

Market Trend

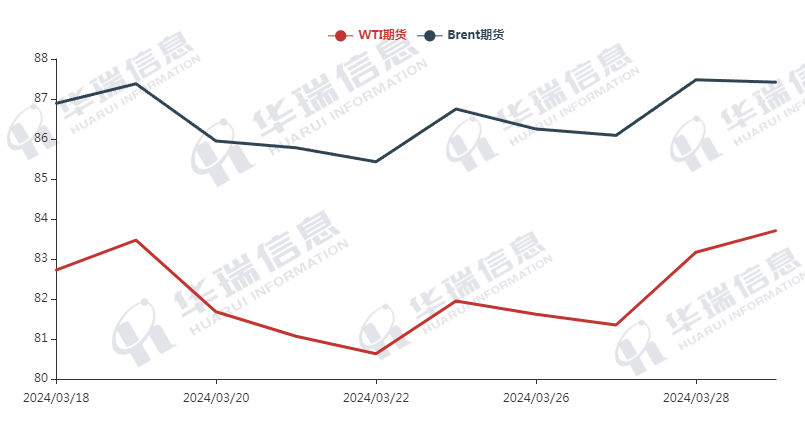

WTI/Brent ( March 18th - April 1st, 2024 )

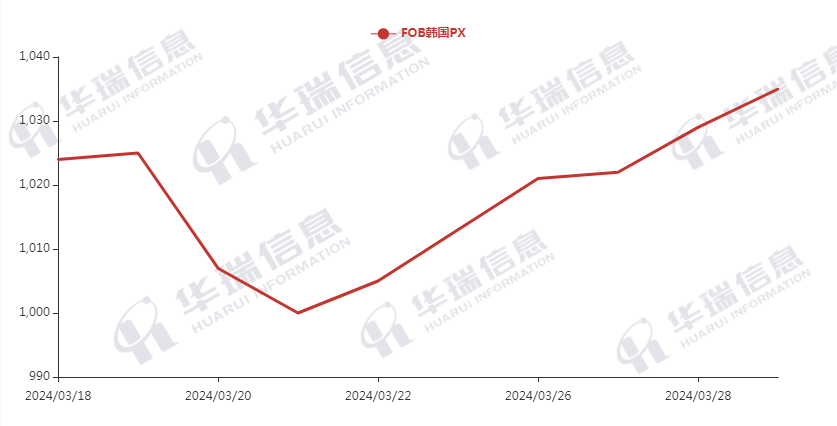

PX ( March 18th - April 1st, 2024 )

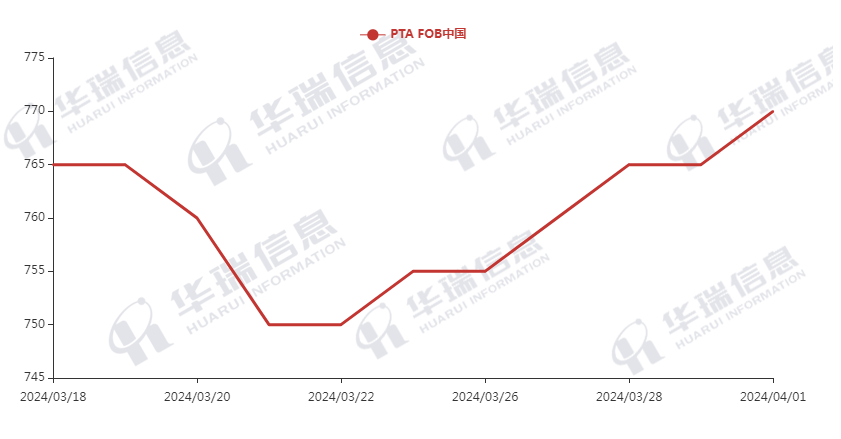

PTA( March 18th - April 1st, 2024 )

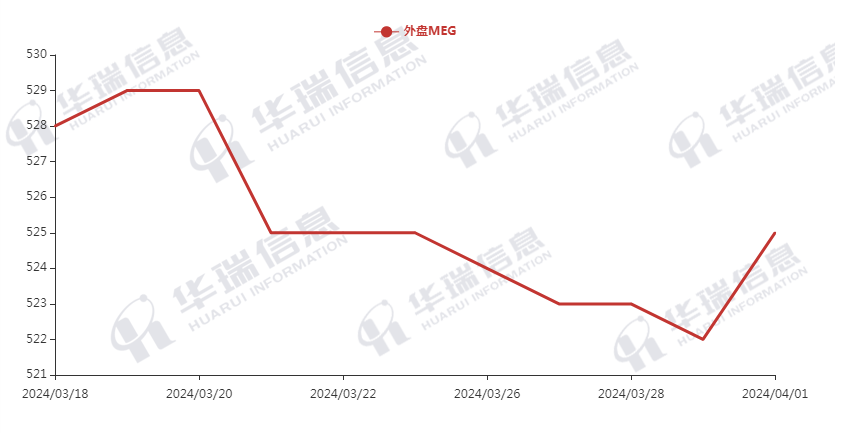

MEG( March 18th - April 1st, 2024 )

1. Polyester Filament

On Monday, international crude oil closed higher with shock. Geopolitical risks continue to support oil prices. On April 1st at local time, Israel airstrike the Iranian Embassy in Syria, causing casualties. The geopolitical situation may show signs of heating up.

On production side, the operation rate of the downstream remains at a high level. After the inventory of raw materials decreased, the procurement cycle shortened. The purchasing atmosphere improved in April, and the production and sales reached 250% yesterday.

Supported by the rising cost and no inventory pressure, factories increased prices this morning. In the meantime, polyester yarn prices are near the cost line, it is expected that the short-term prices may rise to a certain extent. It’s suggested that you can purchase as per your orders to avoid any risks. In the long term, it’s necessary to pay attention to fluctuations in raw material cost, polyester load, and the international situation.

2. PSF

The price of PSF rose yesterday, its transaction improved. Crude oil rose slightly in night session, the futures of polyester raw materials and PSF maintained a strong trend. Factory’s quotations maintained stable in early trading. There has been a lot of replenishment in the downstream recently. It’s necessary to focus on if the futures will go up further.

3. VSF

Recently, the rigid-demand for VSF has increased slightly recently. The mainstream factories still keep the price with a strong sense and the delivery situation of some lots behaves tense. It’s recommended that you can keep a certain level of inventory to avoid any risks.

4. Spandex

Currently, there is no big change for spandex market, and the prices are based on negotiation. It’s recommended that you procure based on your orders and demand.

5. Nylon

The trend of benzene is still strong, the CPL spot price has stabilized, and the rebound is temporarily unfavorable. The transactions of conventional spinning chips are mainly based on firm demands and the rise in pure benzene has led to concentrated replenishment before the holiday. Yesterday's transaction was good. The high-speed spinning is mainly focus on contract execution. It is recommended to purchase as per your demands.