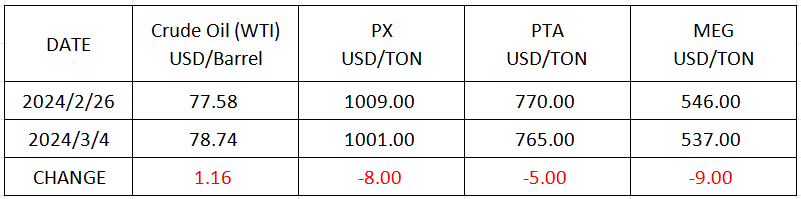

Market Trend (Feb.19th - Mar.4th, 2024)

Market Trend

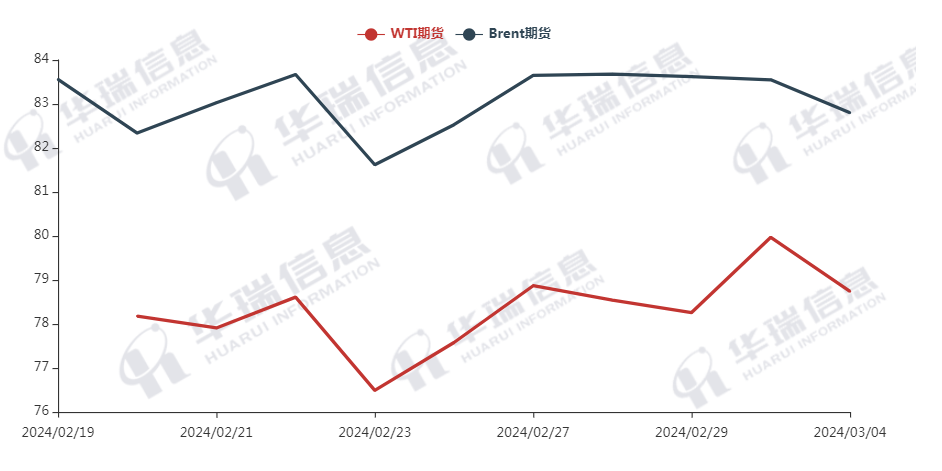

WTI/Brent ( February 19th - March 4th, 2024)

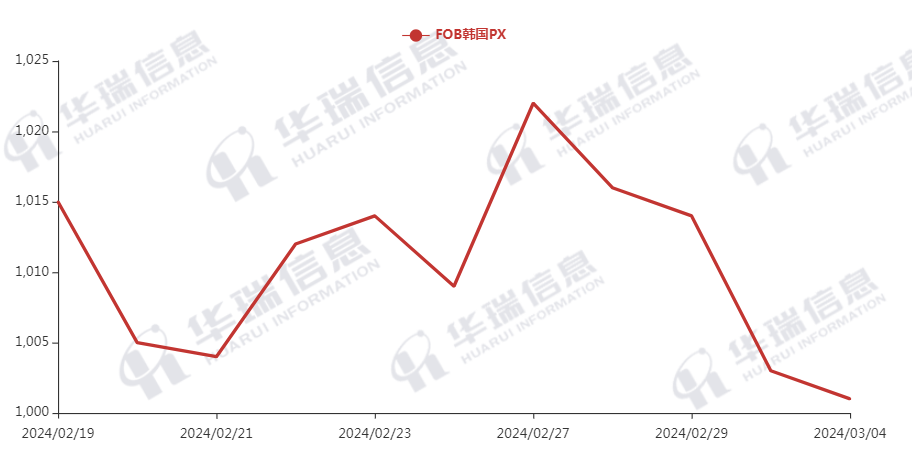

PX ( February 19th - March 4th, 2024)

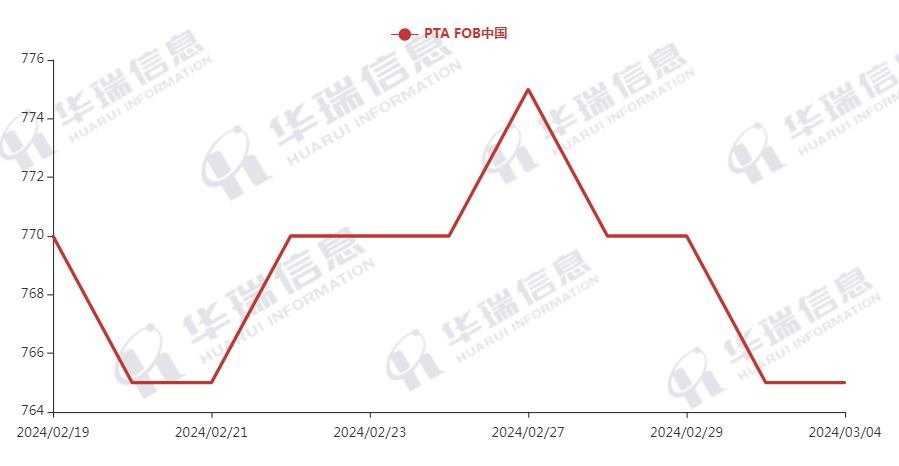

PTA( February 19th - March 4th, 2024)

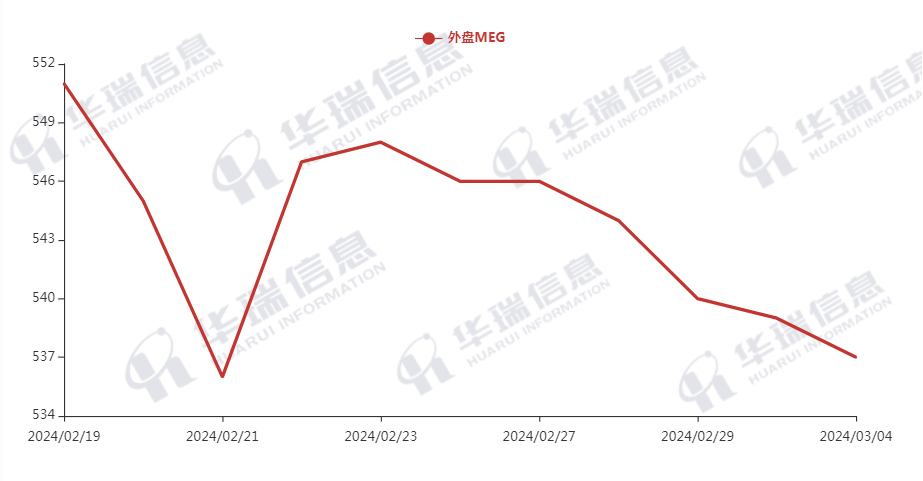

MEG( February 19th - March 4th, 2024)

1. Polyester Filament

Gaza ceasefire negotiations have entered their second day, while OPEC+ cuts its production, the price of International crude oil fluctuated.

Mar. is the traditional hot season, the operation rate of the downstream return to the high level gradually.Due to the good delivery statue, the yarn factories would like to keep the prices. It is expect that the prices would be robust during short term.

It’s expected that the cost will fluctuate slightly in the short term. In the long term, it’s necessary to pay attention to fluctuations in raw material cost, polyester load, and the situation of downstream operation.

2. PSF

The PSF market performs general. Crude oil fluctuated in night session, the futures of polyester raw materials and PSF are volatile . Currently, the discounts for PSF were reduced, deals are mainly based on negotiation. Factories mainly executed in-hand orders and the prices maintain stable. In the long term, need to pay attention to cost side and the resume situation of downstream.

3. VSF

At present, the mainstream viscose is mainly priced at 13,500-13,700 yuan/ton, with prices at the low end of the range gradually decreasing, and performance is still strong in a short-term. The prices of Lyocell fiber are relatively stable.

The downstream production has basically resumed, The current VSF trend is still keeping relatively optimistic because the peak season usually arrives around March. It’s recommended that you keep a certain level of inventory to avoid any risks.

4. Spandex

Currently the spandex market mainly maintains stable. Factories are mainly execute in-hand orders.The spandex demand improved with the gradual resuming work of downstream.Its recommended that you procure based on your orders and demand to avoid any risks.

5.Nylon

The price of pure benzene remained stable at high price. However the CPL price went down because the transaction of CHIPS weaken. The downstream demand gradually started a new round of replenishment by demands, High-speed spinning continues to maintain a good trend due to the overall high start-up of factories, and contract execution is mainly stable. It is recommended to buy as per firm order to avoid any risks.