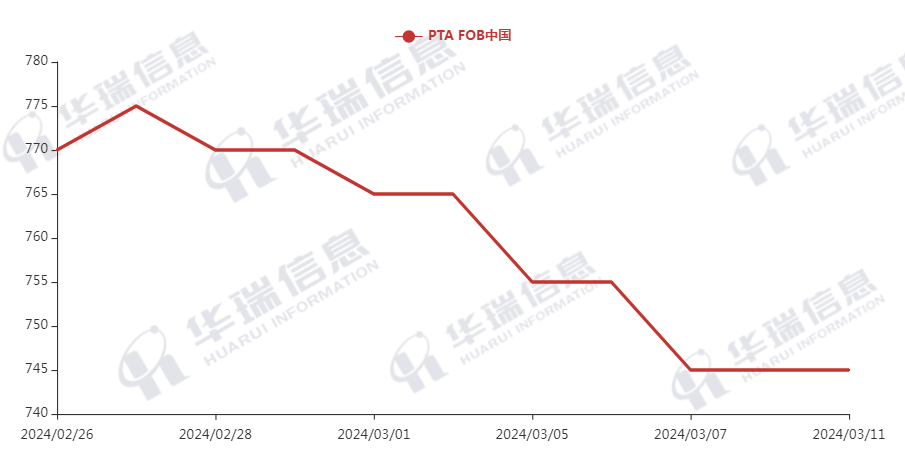

Market Trend (Feb. 26nd - Mar.11th,2024)

Market Trend

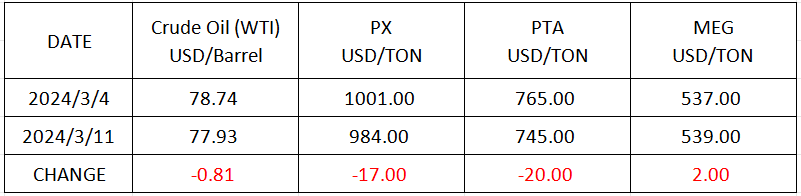

WTI/Brent ( February 26th - March 11th, 2024 )

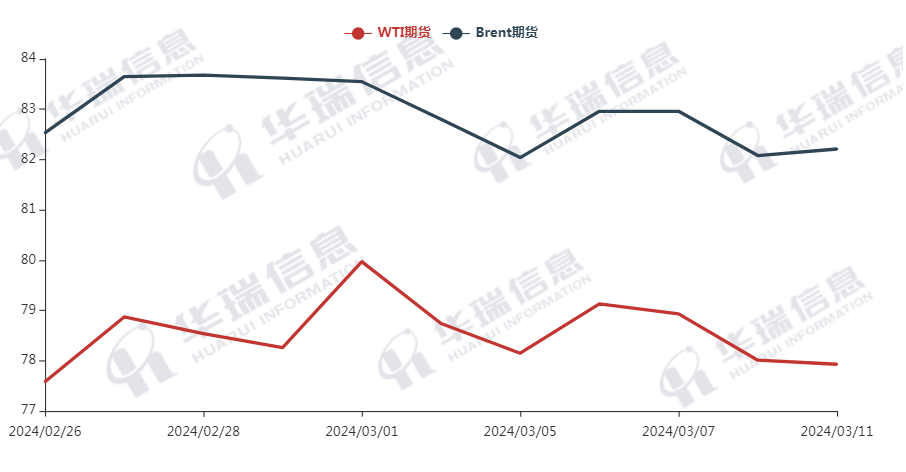

PX ( February 26th - March 11th, 2024 )

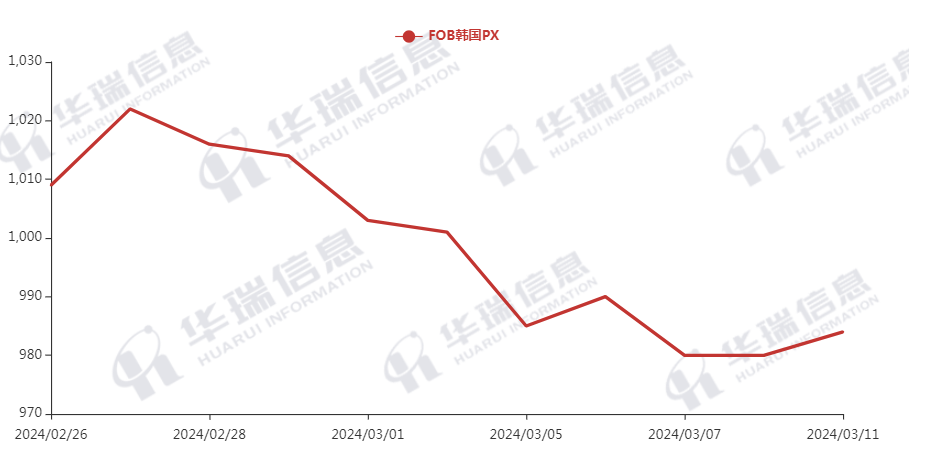

PTA( February 26th - March 11th, 2024 )

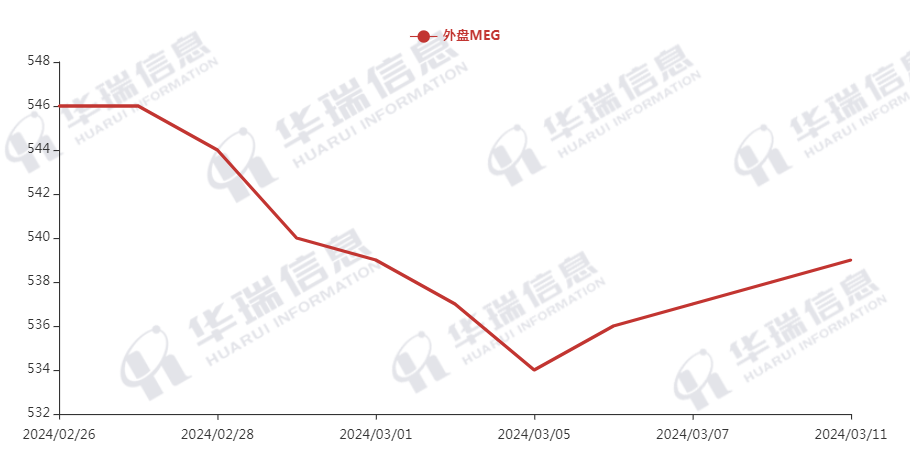

MEG( February 26th - March 11th, 2024 )

1. Polyester Filament

The Crude oil kept fluctuating. The cost of polyester raw material followed to fluctuate.

Regarding production side, the operation rate of the downstream has returned to a relatively high level. With the smooth digestion of short-term polyester filament, factories’ inventory have reduced gradually. As the time for some downstream stocks are depleted approaches, the production and sales of polyester factories can be expected to increase. It’s suggested that you can purchase as per your order to avoid any risks.

It’s expected that the cost will keep range shock in the short term. In the long term, it’s necessary to pay attention to fluctuations in raw material cost, polyester load, and the situation of downstream operation.

2. PSF

The PSF market performs general and transaction is based on negotiation. Currently,most spot quotations remained stable in early trading, and transactions were negotiated according to orders. In the long term, need to pay attention to cost side and the situation of downstream resumption.

3. VSF

The market of VSF performed stable. Currently, the deal situation of mainstream VSF factories is pretty good and they are mainly executing in-hand orders. The market still keeps relatively optimistic attitude. So it’s recommended that you keep a certain level of inventory to avoid any risks.

4. Spandex

Currently the spandex market maintains stable. But some suppliers increased by 1000cny/ton for the main raw material of spandex: PTMEG and factories ship in-hand orders actively. Its recommended that you procure based on your orders and demand to avoid any risks. And the follow-up of downstream orders and spandex replenishment still needs to be payed attention to.

5. Nylon

The price of pure benzene rebounded and rose. In the meantime, the CPL supply was loose and still weak. The conventional spinning chip prices picked up, and the high-speed spinning is mainly focus on contract execution , and low-end spot prices also improved slightly. It is recommended to stock up moderately when the price stay in a relatively low level.